The AI Revolution in Finance: Reshaping Money Management for Everyone 🚀

How Artificial Intelligence and Machine Learning Are Transforming FinTech and What It Means for You

Table of contents

- Article Key Takeaways

- A Brief History: From Coffee Houses to Algorithms

- How AI Is Transforming Financial Services

- Supercharged Risk Assessment

- Fraud Detection on Steroids

- Virtual Financial Assistants

- Personalized Investment Advice

- Streamlined Operations

- The Benefits of AI in Finance

- 💰 Cost Savings and Revenue Growth

- 🎯 Enhanced Accuracy and Efficiency

- 😊 Improved Customer Experience

- 🔒 Enhanced Security and Compliance

- Challenges and Ethical Considerations

- Regulatory Hurdles

- Algorithmic Bias and Fairness

- Data Privacy and Security

- The Human Element

- The Future of AI in Finance

- Decentralized Finance (DeFi)

- Sustainable Finance

- Enhanced Personalization

- Improved Explainability

- Quantum Computing

- Case Studies: AI in Action

- JPMorgan Chase: COiN for Contract Intelligence

- Ant Financial: Facial Recognition for Payments

- Betterment: AI-Driven Robo-Advisor

- FICO: AI for Credit Scoring

- Lemonade: AI in Insurance Claims

- Further References & Infography

- Conclusion: Embracing AI Revolution in Finance

Artificial intelligence (AI) and machine learning (ML) have stormed onto financial scene, shaking up how we handle cash and make monetary decisions. From robo-advisors to fraud detection systems, these technologies make finance smarter, faster, and more accessible than ever before. But what does this AI revolution mean for average folks? And what hurdles lie ahead as we entrust more of our financial lives to algorithms? Let’s dive in and explore exciting world of AI in fintech! 🤖💰

Article Key Takeaways

AI and ML revolutionize risk assessment, fraud detection, and customer service in finance

Challenges include regulatory compliance, data privacy, and algorithmic bias

Future trends point towards decentralized finance, sustainable solutions, and enhanced consumer empowerment

A Brief History: From Coffee Houses to Algorithms

Financial world has come a long way since bustling stock exchanges in 17th-century coffee houses. Today, algorithms make split-second trades and chatbots handle customer service. This journey from human-centric to AI-driven finance didn’t happen overnight.

Back in early 2000s, researchers like Lo proposed “Adaptive Market Hypothesis,” mixing psychology and economics to better understand investor behavior. This laid groundwork for using AI to make smarter financial decisions. In recent years, deep reinforcement learning has taken things to whole new level, allowing for super sophisticated models that predict market trends and assess risk like never before.

High-frequency trading and algorithmic decision-making have become norm in modern financial markets. These systems can analyze vast amounts of data and execute trades in milliseconds, far outpacing human capabilities.

But it hasn’t all been smooth sailing. Regulators have had to keep up with times too. For example, in 2016, U.S. Securities and Exchange Commission gave green light for certain exchanges to use “speed bumps” to regulate high-frequency trading. This aimed to make markets more transparent and stable as technology advanced.

And now we’ve got generative AI hitting scene, sparking whole new wave of innovation in finance. Banks and investment firms are starting to use it more and more, recognizing its potential to boost productivity and decision-making. But there are still some hurdles to overcome, like making sure employees know how to actually use these fancy new tools effectively.

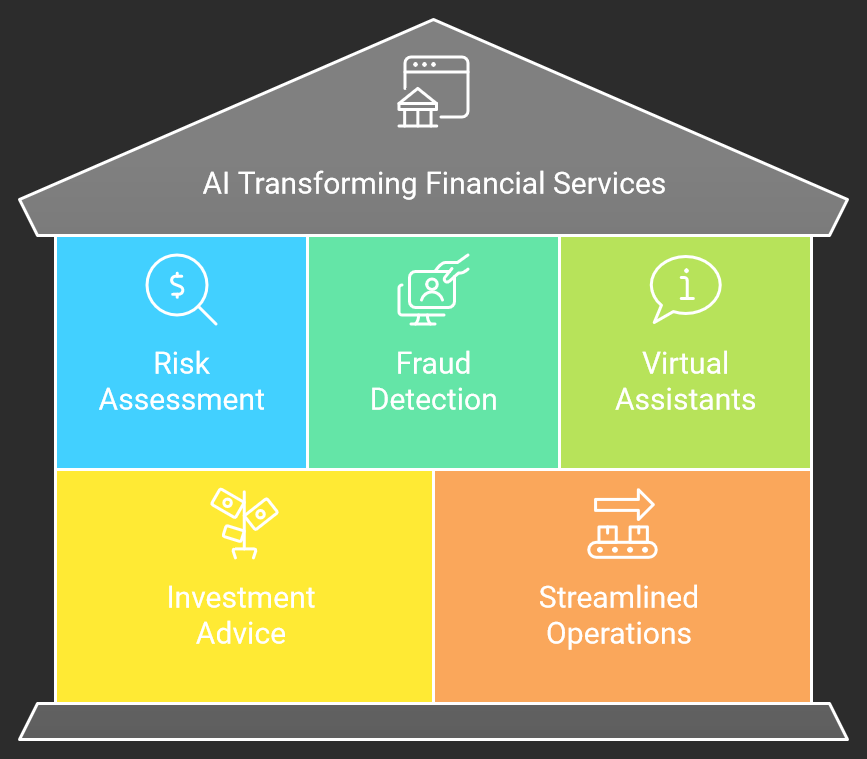

How AI Is Transforming Financial Services

Supercharged Risk Assessment

One of biggest ways AI shakes things up lies in risk assessment. Gone are days of relying solely on credit scores and gut feelings. AI algorithms can now analyze massive amounts of data to get much more nuanced picture of someone’s financial situation.

For example, let’s say you’re applying for loan. An AI system might look at your credit history, income, spending patterns, and even social media activity to determine how likely you are to repay. This can lead to fairer, more accurate lending decisions, especially for people who might not have traditional credit history.

But it’s not just about individual loans. AI also helps financial institutions assess market risks and make smarter investment decisions. By crunching huge amounts of data, these systems can spot trends and patterns that human analysts might miss.

AI-driven risk assessment tools have become increasingly sophisticated, with some estimates suggesting they could represent a $31 billion market by 2030. These tools not only analyze traditional financial data but also incorporate factors like climate risk into their models.

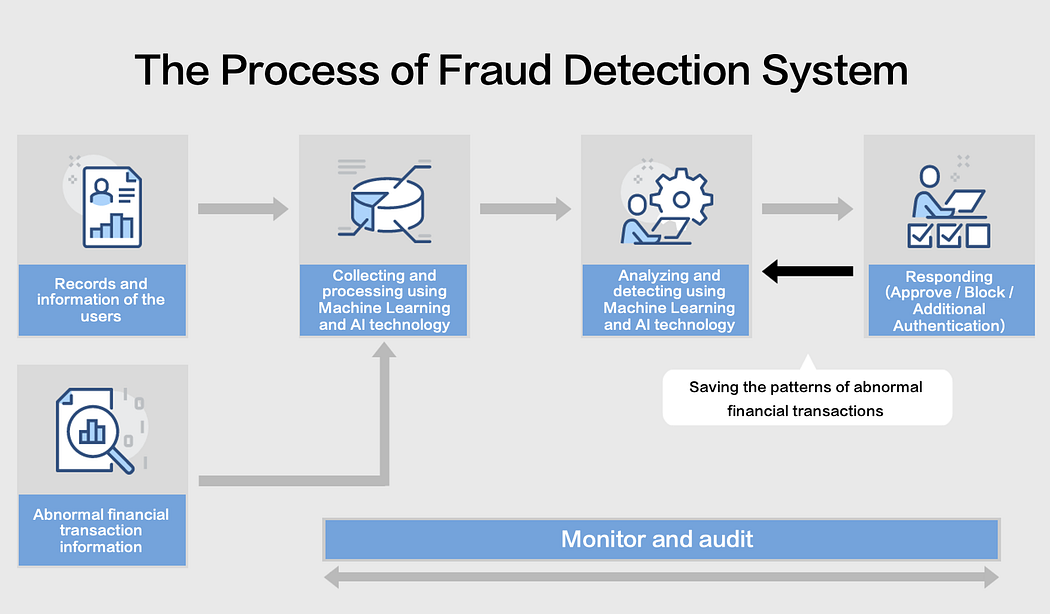

Fraud Detection on Steroids

Fraud has always been major headache for financial industry. But AI gives banks and credit card companies powerful new weapon in fight against fraudsters.

AI-powered fraud detection systems can monitor transactions in real-time, flagging suspicious activity before any money changes hands. These systems are constantly learning and adapting, becoming better at spotting new fraud tactics as they emerge.

Here’s cool example: Some fraud detection systems now use something called “behavioral biometrics” to analyze how you interact with your devices. Way you type, swipe, or even hold your phone can create unique “fingerprint” that’s hard for fraudsters to fake.

Machine learning algorithms have proven particularly effective in detecting fraudulent activities. These systems can analyze patterns across millions of transactions, identifying anomalies that might indicate fraud with a level of accuracy and speed that human analysts simply can’t match.

Virtual Financial Assistants

Remember when you had to wait in line at bank to check your balance or make transfer? Those days are long gone thanks to AI-powered virtual assistants.

Big banks are getting in on action. Bank of America has Erica, virtual assistant that helps millions of customers with everyday banking tasks. Capital One’s Eno does similar stuff, helping people solve common banking problems and manage their accounts.

These virtual assistants are getting smarter all time. They can analyze your spending habits, offer personalized financial advice, and even help you set and stick to budgets. It’s like having personal financial advisor in your pocket 24/7.

AI-powered chatbots and virtual assistants are becoming increasingly sophisticated, capable of handling complex queries and providing personalized financial advice. Some can even detect emotional cues in customer interactions, allowing for more empathetic and effective customer service.

Personalized Investment Advice

Speaking of financial advisors, AI also shakes up world of investment management. Robo-advisors are becoming increasingly popular, offering personalized investment advice based on your goals, risk tolerance, and financial situation.

These AI-powered platforms can create and manage diversified portfolios, automatically rebalancing as needed and even taking care of tax-loss harvesting. This democratizes access to sophisticated investment strategies that were once only available to wealthy.

AI-driven portfolio management tools can analyze market trends, economic indicators, and individual investor preferences to create and manage optimized investment portfolios. These systems can react to market changes in real-time, potentially outperforming traditional investment strategies.

Streamlined Operations

Behind scenes, AI makes financial institutions run more smoothly and efficiently. One example is automated document processing. A US insurance company developed AI system that can extract data from PDF invoices automatically, matching missing information and detecting duplicates. This kind of automation saves time, reduces errors, and frees up human employees to focus on more complex tasks.

AI-powered process automation is transforming back-office operations in financial institutions. From automated underwriting to intelligent document processing, these systems are reducing processing times, minimizing errors, and significantly cutting operational costs.

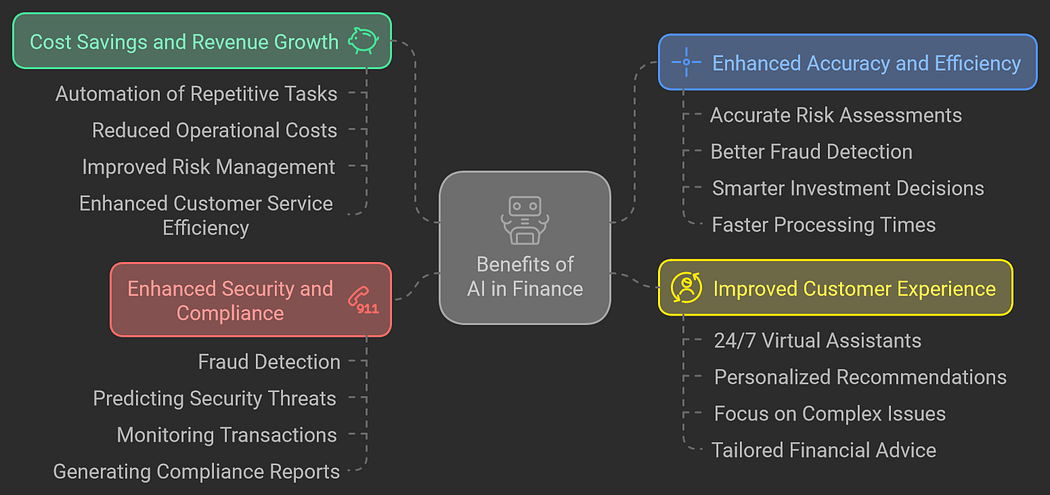

The Benefits of AI in Finance

💰 Cost Savings and Revenue Growth

AI acts as game-changer when it comes to cutting costs and boosting revenue. By automating repetitive tasks, financial institutions can save big on labor costs. And improved efficiency and decision-making enabled by AI can lead to significant revenue growth.

According to some estimates, AI could save S&P 500 companies whopping $65 billion over next five years. That’s some serious cash!

AI-driven cost savings in financial services come from various sources, including reduced operational costs, improved risk management, and enhanced customer service efficiency. These savings can be reinvested in innovation and growth initiatives.

🎯 Enhanced Accuracy and Efficiency

Humans are great, but we’re not perfect. We get tired, we make mistakes, and we have biases. AI, on other hand, can work tirelessly, analyze massive amounts of data, and make decisions based purely on facts and patterns.

This leads to more accurate risk assessments, better fraud detection, and smarter investment decisions. It also means faster processing times for things like loan applications and account openings.

Machine learning models have shown remarkable accuracy in predicting financial risks and market trends. In some cases, these models have outperformed traditional statistical methods and human experts in areas like credit scoring and stock price prediction.

😊 Improved Customer Experience

AI helps financial institutions provide more personalized and responsive customer service. Virtual assistants can answer questions and solve problems 24/7. Personalized recommendations can help customers find right products and services for their needs.

And because AI can handle many routine tasks, human customer service reps can focus on more complex issues, providing better support when it really matters.

AI-powered personalization in financial services goes beyond simple product recommendations. Advanced AI systems can analyze customer behavior, financial goals, and market conditions to provide highly tailored financial advice and product offerings.

🔒 Enhanced Security and Compliance

AI acts as powerful tool for detecting and preventing fraud. It can spot suspicious patterns in real-time and even predict potential security threats before they happen.

On compliance front, AI can help financial institutions stay on top of ever-changing regulations. Automated systems can monitor transactions for potential violations and generate reports for regulators, saving time and reducing risk of costly compliance errors.

AI in regulatory compliance is becoming increasingly sophisticated. These systems can not only detect potential compliance issues but also predict future regulatory changes, helping financial institutions stay ahead of regulatory curve.

Challenges and Ethical Considerations

While AI in finance offers many benefits, it also comes with its fair share of challenges and ethical concerns.

Regulatory Hurdles

Financial services are highly regulated, and for good reason. As AI becomes more prevalent, regulators are scrambling to keep up. There are concerns about transparency, fairness, and accountability, especially when it comes to AI-driven lending decisions.

General Data Protection Regulation (GDPR), for example, poses some specific challenges for AI in finance. How do you ensure right to erasure when AI system has used someone’s data to make decisions? How do you explain complex AI decision-making processes in way that satisfies regulatory requirements?

Regulatory frameworks for AI in finance are still evolving. Financial institutions must navigate complex landscape of existing regulations while also preparing for future AI-specific regulations.

Algorithmic Bias and Fairness

One of biggest concerns with AI in finance lies in potential for bias. If AI system gets trained on historical data that reflects societal biases, it could perpetuate or even amplify those biases in its decisions.

For example, if loan approval algorithm gets trained on data from time when certain groups were systematically denied loans, it might continue to discriminate against those groups, even if that’s not intention.

Ensuring fairness and avoiding discrimination in AI-driven financial decisions remains major challenge that industry grapples with.

Algorithmic fairness in finance is complex issue with no easy solutions. Financial institutions are exploring various techniques, such as fairness-aware machine learning and diversity in AI development teams, to address these challenges.

Data Privacy and Security

AI systems need data, lots of it. But collecting and storing all that financial data comes with serious privacy and security concerns. How do you balance need for data with individuals’ right to privacy? And how do you protect all that valuable financial information from cybercriminals?

As AI technologies become more accessible, there’s also risk that bad actors could use them to create more sophisticated cyberattacks. Financial institutions need to stay one step ahead, constantly updating their security measures.

Data privacy in AI-driven finance is critical concern. Financial institutions are investing heavily in advanced encryption technologies, secure data storage solutions, and robust data governance frameworks to protect sensitive financial information.

The Human Element

As AI takes over more tasks in financial industry, there are concerns about job displacement. While AI creates new job opportunities, it also has potential to automate many existing roles.

There’s also question of how much we should rely on AI for important financial decisions. While AI can process vast amounts of data and spot patterns humans might miss, there’s still value in human judgment and intuition, especially in complex or nuanced situations.

The future of work in finance with AI is likely to involve collaboration between humans and machines. While some jobs may be automated, new roles focused on AI oversight, ethical considerations, and complex decision-making are likely to emerge.

The Future of AI in Finance

So what does future hold for AI in finance? Here are some exciting trends to watch:

Decentralized Finance (DeFi)

Blockchain technology and cryptocurrencies are opening up new possibilities for decentralized financial systems. AI could play big role in managing and securing these new forms of finance.

DeFi and AI integration could lead to creation of more efficient, transparent, and accessible financial systems. AI could help manage complex DeFi protocols, optimize yield farming strategies, and enhance security of blockchain networks.

Sustainable Finance

There’s growing interest in sustainable and socially responsible investing. AI could help analyze companies’ environmental, social, and governance (ESG) performance, enabling more informed sustainable investment decisions.

AI in sustainable finance is rapidly evolving field. AI systems can analyze vast amounts of unstructured data to assess companies’ ESG performance, predict climate-related financial risks, and optimize sustainable investment portfolios.

Enhanced Personalization

As AI systems become more sophisticated, they’ll be able to offer even more personalized financial advice and services. Imagine AI that understands your financial goals, values, and risk tolerance so well that it can manage your entire financial life seamlessly.

Hyper-personalization in finance powered by AI could revolutionize how we interact with financial services. From personalized investment strategies to tailored insurance products, AI could enable level of customization previously unimaginable.

Improved Explainability

As regulators and consumers demand more transparency, AI researchers are working on ways to make AI decision-making more explainable. This could lead to “glass box” AI systems in finance where we can clearly see and understand how decisions are being made.

Explainable AI in finance is becoming increasingly important as AI systems take on more critical roles in financial decision-making. Techniques like LIME (Local Interpretable Model-agnostic Explanations) and SHAP (SHapley Additive exPlanations) are being developed to make AI decisions more transparent and understandable.

Quantum Computing

Looking further ahead, quantum computing could supercharge AI in finance, enabling even more complex and accurate financial models and predictions.

Quantum computing in finance has potential to solve complex optimization problems, enhance cryptography for secure transactions, and enable more accurate risk assessments. While still in early stages, quantum AI could lead to breakthroughs in areas like portfolio optimization and fraud detection.

Case Studies: AI in Action

Let’s look at some real-world examples of how AI transforming finance:

JPMorgan Chase: COiN for Contract Intelligence

JPMorgan Chase developed AI system called COiN (Contract Intelligence) to analyze legal documents and extract important data points. This system can review 12,000 annual commercial credit agreements in seconds, task that would take 360,000 hours for human lawyers to complete.

Ant Financial: Facial Recognition for Payments

Chinese fintech giant Ant Financial uses facial recognition technology powered by AI for its “Smile to Pay” system. This allows customers to make payments simply by smiling at camera, enhancing convenience and security of transactions.

Betterment: AI-Driven Robo-Advisor

Betterment, popular robo-advisor platform, uses AI to provide personalized investment advice and portfolio management. Their algorithms consider factors like user’s financial goals, risk tolerance, and market conditions to create and manage optimized investment portfolios.

FICO: AI for Credit Scoring

FICO, company behind widely used credit scores, has incorporated machine learning into its latest scoring model, FICO Score 10 T. This new model can analyze trended data, providing more accurate picture of consumer’s credit behavior over time.

Lemonade: AI in Insurance Claims

Insurance company Lemonade uses AI chatbot named Jim to handle insurance claims. In some cases, Jim can review claim, cross-reference it with policy, run anti-fraud algorithms, and approve payment within seconds.

These case studies demonstrate how AI transforming various aspects of finance, from back-office operations to customer-facing services. As technology continues to evolve, we can expect to see even more innovative applications of AI in financial sector.

Further References & Infography

AI in Finance: How Artificial Intelligence is Transforming the Financial Industry

AI in Banking Explained for Beginners | Learn Artificial Intelligence

How AI is Transforming Finance

Infography

Conclusion: Embracing AI Revolution in Finance

Integration of AI and ML in fintech isn’t just passing trend — it’s fundamental shift in how we approach finance. From smarter risk assessment to personalized financial advice, AI makes finance more efficient, accurate, and accessible.

But as we embrace these new technologies, we must also grapple with challenges they present. Ensuring fairness, protecting privacy, and maintaining human oversight will be crucial as AI becomes more prevalent in our financial lives.

Future of finance undoubtedly appears AI-powered. By understanding both potential and pitfalls of this technology, we can work towards financial system that’s not just smarter, but also fairer and more inclusive for everyone. 🌟💼

As we move forward, it’s important to stay informed about these developments. Whether you’re financial professional, tech enthusiast, or just someone who wants to make smarter money decisions, understanding role of AI in finance will be key to navigating financial landscape of future.

What are your thoughts on AI in finance? Are you excited about possibilities, or do you have concerns about entrusting your financial decisions to algorithms? Share your thoughts and experiences in comments below!

So stay tuned for updates on these futures. And if you found this glimpse beyond the bleeding edge compelling, hit those clap buttons to help spread the word!

If you want to read more interesting content don’t forget to check on my blog.